Your neighbor swears by property, your coworker swears by stocks—so who’s actually right?

Veda Financial | September 2025

Your neighbor swears by property, your coworker swears by stocks—so who’s actually right?

Veda Financial | September 2025

Why Comparing Stocks to Real Estate Isn’t Apples to Apples

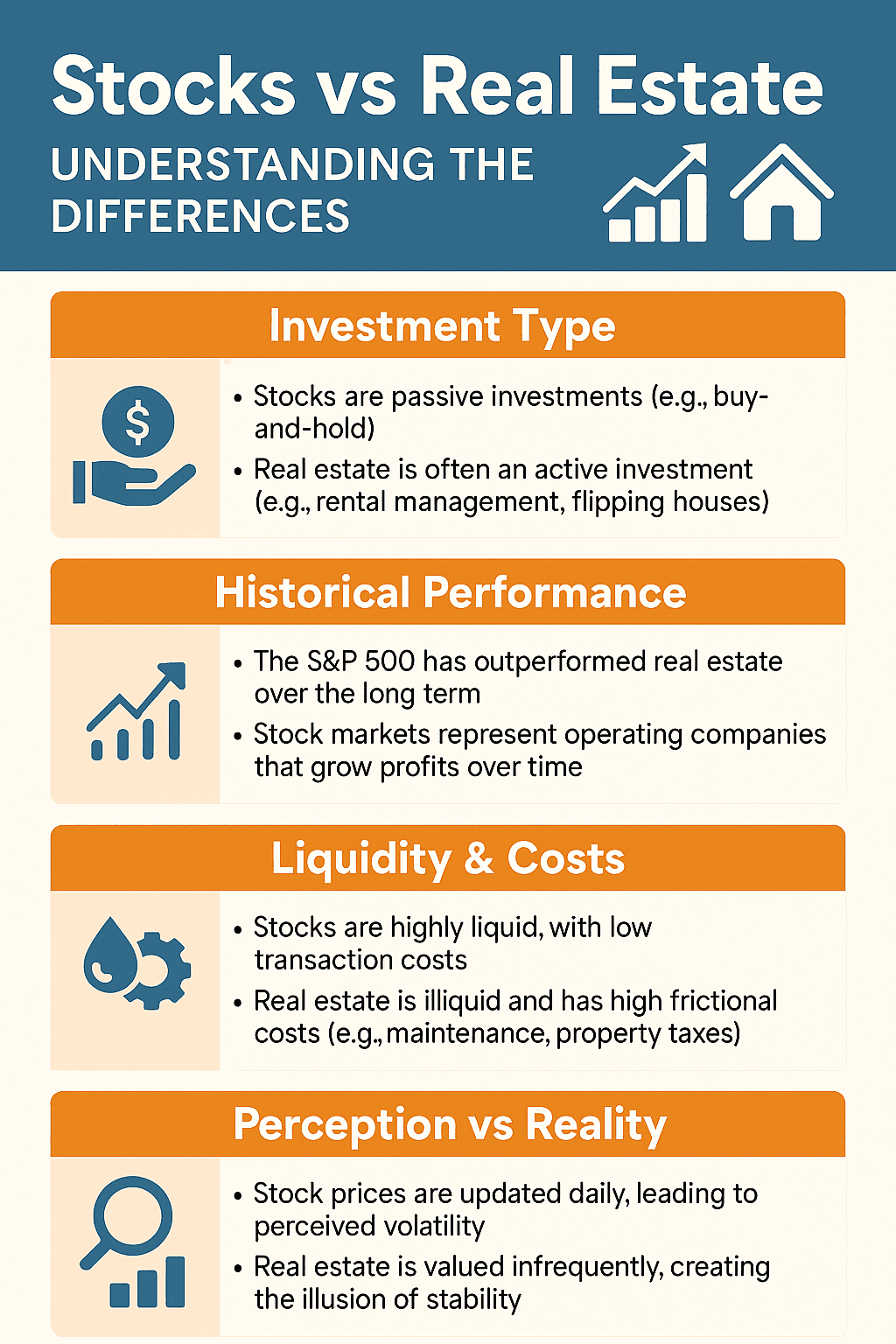

Many people will tell you they’ve made “a fortune” in real estate. And in some cases, they absolutely have. But here’s the part that often gets glossed over: most of the people who’ve truly profited weren’t passive investors. They were running what amounts to an operating business—flipping houses, actively managing rentals, developing property, or running commercial spaces. That’s not the same thing as a passive buy-and-hold investment.

If we strip real estate down to its truly passive form—the equivalent of “buy it and forget it”—what we’re left with is investing through a real estate index, such as a REIT index fund. And here’s where the data tells a different story.

Stocks vs. Passive Real Estate Performance

Over long periods, the S&P 500 has historically delivered higher compounded annual growth rates than real estate indexes. That’s because the S&P 500 represents operating companies—businesses generating profits, reinvesting, innovating, and compounding returns for shareholders.

Real estate indexes do provide income and diversification benefits, but after factoring in maintenance, property taxes, insurance, transaction costs, and periods of vacancy, the net return tends to lag stocks over time.

Real estate also comes with significant friction: high transaction costs, illiquidity, and time commitments. Stocks, by contrast, are liquid, low-cost to buy and sell, and don’t require you to field a 2 a.m. call about a broken water heater.

Example: A friend told me they “doubled their money” on a house sale. When I asked about the time frame, it turned out to be 10 years. Using the Rule of 72, that works out to about a 7% annualized return—roughly what you could get from a safe bond or a balanced dividend-reinvestment strategy in the market.

The Illusion of “Real Estate Always Goes Up”

Another common misconception is that “real estate only goes up while stocks are volatile.” What’s really happening is this:

Stocks are priced daily. Investors see the ups and downs in real time, which makes volatility very visible.

Real estate is priced infrequently. A home may be held for 10 years with no valuation until it’s sold, so the owner sees only the final (hopefully higher) price. That creates the illusion of stability—but in reality, real estate markets also have major downturns (think 2008).

The long-term trend for both asset classes is upward, but for different reasons. Real estate rises largely with inflation and population/demand growth. Stocks rise because operating companies generate profits and grow in real terms, outpacing inflation.

Example: Someone might say, “My property went up 50% in 15 years.” Sounds great—but that’s only about a 2.7% annualized return, not much higher than inflation. Compare that to the S&P 500 over the same period, which historically compounded closer to 9–10% per year.

Why Balance Matters

If your entire net worth is in real estate, you’re effectively tied up in one illiquid, high-friction asset class. That may have worked in the past, but it leaves you exposed to concentrated risks—local economic downturns, interest rate spikes, or simply the inability to sell when you want to. By contrast, stocks provide global diversification, liquidity, and historically stronger returns over time.

Example: A $500,000 investment in U.S. REITs 20 years ago would today be worth about $2 million. The same amount invested in the S&P 500 would be closer to $3.2 million. Both grew, but one compounded wealth significantly faster while requiring no upkeep.

The smartest approach is balance:

Keep some allocation to real estate for income and inflation protection.

Maintain a liquid, diversified stock portfolio for growth, flexibility, and compounding.

At the end of the day, wealth grows most reliably when you combine both—recognizing real estate for what it is, and giving stocks the credit they deserve as the ultimate engine of long-term growth.

Veda Financial @ Charles Schwab

Individual, Company, IRA, 401K, Trusts

Registered Investment Adviser #173448

Life Insurance, Annuity & LTC Lic. #0I02070

⚠️ Disclaimer: This article is for informational purposes only and does not constitute investment, tax, or legal advice. Past performance is not a guarantee of future results. Investing involves risk, including possible loss of principal. Please consult with a qualified financial advisor before making investment decisions.

Veda Financial and its advisors may hold positions in some of the securities or industries mentioned.