The Belle of the Ball Veda Financial | September 2025

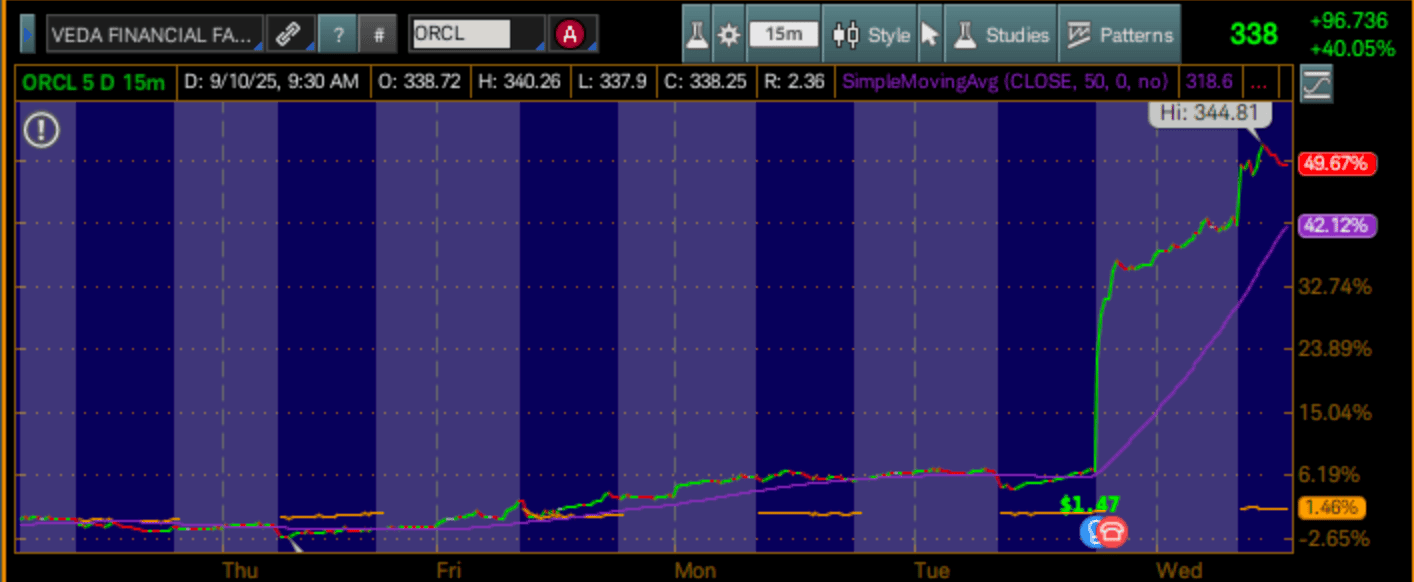

Every so often, the market crowns a new Cinderella. A company written off as too slow, too old, or too far behind suddenly arrives at the ball, dazzling investors. This week, that surprise guest was Oracle — a stock that soared nearly 50% in just days, reaching a valuation close to $285 billion in market value and knocking on the door of the trillion-dollar club.

The Transformation

For years, Oracle carried the reputation of a legacy database giant—reliable, but hardly exciting. In cloud computing, it trailed far behind AWS, Microsoft Azure, and Google. Few imagined it would suddenly become one of Wall Street’s brightest stories of 2025.

What changed? The answer lies in three letters driving almost every market headline: AI.

The Big Reveal

At its latest earnings, Oracle didn’t just talk about growth—it unveiled staggering numbers:

Cloud infrastructure revenue is projected to rise 77% year-over-year, with a roadmap that scales to $144 billion by 2030.

Its remaining performance obligations (RPO)—future revenue already under contract—skyrocketed 359% to $455 billion, with expectations to pass $500 billion soon.

Oracle announced multi-billion-dollar contracts with AI leaders including OpenAI, Meta, Nvidia, and Elon Musk’s xAI. These deals position Oracle as a critical backbone for AI workloads, especially the massive Stargate project.

The irony? Oracle slightly missed earnings estimates on revenue and EPS. But investors didn’t care. The scale of forward contracts and AI exposure overshadowed everything else.

Why It Matters

In a single week, Oracle vaulted from a $678 billion market cap to nearly $970 billion, placing it shoulder-to-shoulder with the biggest names in tech. That’s a $285 billion leap in valuation—larger than the market cap of Intel or Netflix—created almost overnight.

For investors, this story is a reminder that market leadership can shift suddenly when long-term themes crystallize. Cloud and AI aren’t just buzzwords—they’re redrawing the competitive map of technology. And sometimes, the company least expected to lead the dance ends up at the center of the ballroom.

Takeaway for Investors

When evaluating companies in fast-moving industries, don’t just look at quarterly earnings. Pay close attention to backlog and contractual obligations (RPO)—they can be a stronger signal of future growth than current revenue. And keep an eye on the so-called “laggards.” In an environment where technology shifts rapidly, yesterday’s underdog can become tomorrow’s trillion-dollar Cinderella.

Five day graph of the price of Oracle stock of 50% (green and red line) versus the S&P 500 (yellow line) up 1.5% in that time

Veda Financial @ Charles Schwab

Individual, Company, IRA, 401K, Trusts

Registered Investment Adviser #173448

Life Insurance, Annuity & LTC Lic. #0I02070

⚠️ Disclaimer: This article is for informational purposes only and does not constitute investment, tax, or legal advice. Past performance is not a guarantee of future results. Investing involves risk, including possible loss of principal. Please consult with a qualified financial advisor before making investment decisions.

Veda Financial and its advisors may hold positions in some of the securities or industries mentioned.